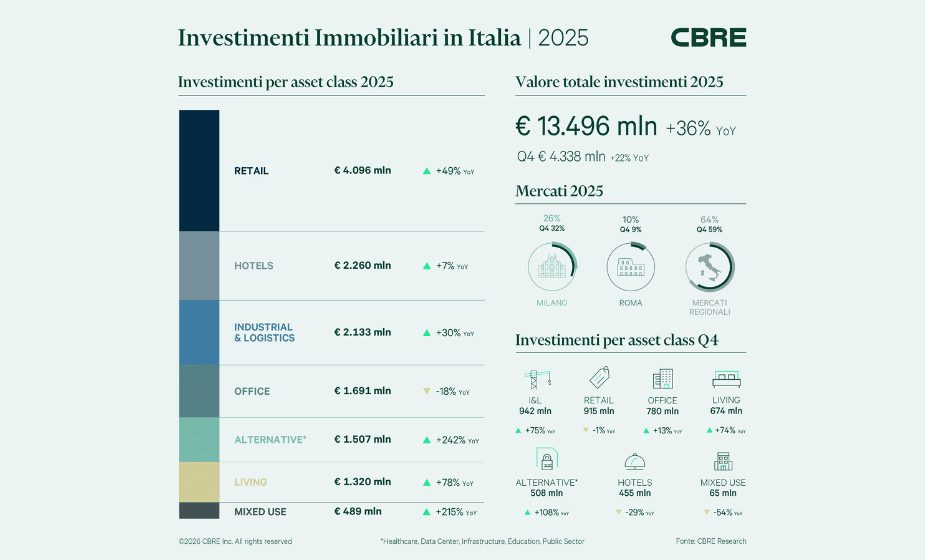

CBRE: “Market grows and gains investor confidence for 2025”

With a investment volume of nearly 10 billion, the 2024 of the commercial real estate nostrano closed with a 47 percent increase over 2023, confirming Italy in an absolute top position among the main European markets, where there is also for 2025 a general optimism on the part of investors, despite widespread concern related in primis to the geopolitical instability that has characterized recent months. It is the state of the art framed by the latest Market Outlook by CBRE, a leader global real estate consulting and services, discussed during the 2025 edition of Perspective, an annual event for investors, media and industry insiders, now in its 10th year.

“A decade of Perspective is the story of a market that has changed its face and boundaries several times, ten years straddling an unprecedented global event like the pandemic, which inevitably challenged real estate at all levels, and where today Italy, with the fourth highest annual result ever, ranks among the top countries to invest in – commented Mirko Baldini, CEO Italy of CBRE, opening the event – In ten years, the total volume of investments in Commercial Real Estate has approached 100 billion euros in total, with a 74 percent increase in the number of transactions from 2015 to 2024. Numbers that launch the Italian market toward certainly positive forecasts for this new year as well.”

INVESTORS’ VIEW: CONFIDENCE IN RECOVERY

In addition to the excellent 2024 numbers, another important result concerns 2025 and emerges from the latest Italian Investor Intentions Survey by CBRE, an annual survey of sentiment which was attended by more than 230 investors active in the Italian market, including investment funds, banks, individuals and other institutional entities in Italy and Europe. According to the study, the 75% of investors say they are optimistic and confident that the recovery of investment activities is already underway and set to consolidate during 2025. An active and concrete optimism: the 64 percent of investors are in fact ready to increase acquisitions during the year.

“We are witnessing a virtuous circle triggered by the normalization of monetary policies and the good performance of occupier markets – explains Giulia Ghiani, Head of Research & Data Intelligence Italy of CBRE commenting on the results – Thanks to the repricing processes of the past few years and the good outlook on interest rate trends, the market now offers excellent entry points, fueling investor enthusiasm for 2025.”

ASSET FOCUS: PERFORMANCE AND FORECAST

After the positive trend noted by CBRE in 2024 for almost every asset class monitored, theItalian Investor Intentions Survey examined investor orientations for 2025: the results show a growing interest in the areas Living (from 26% in 2024 to 28% in 2025), Hotels (16% to 18%) e Retail, that in addition to growing by 236% in 2024 as investment volumes, convinces even more investors for 2025 (increasing from 7 percent to 11 percent). L’asset class that remains most in demand is still Industrial & Logistics, with 29% of preferences from investors.

IN 2025 EVEN IN ITALY EYES ON OPERATIONAL REAL ESTATE

It is confirmed for 2025 the growing investor interest in Operational Real Estate., a sector that in the last two years has reached 2.8 billion euros, up by 16% over the previous biennium. The OPRE sector includes those properties whose cash flows are closely linked to the operating performance of those who occupy them. It is the 70 percent of investors to say they are interested to engage in the OPRE segment, especially for the asset classes Purpose-Built Student Accommodation, Data Centers e Healthcare.

“Operational Real Estate represents a dynamic and strategic set of asset classes for investors due to its ability to generate value through active management and service innovation,” – adds Silvia Gandellini, Head of Capital Markets Italy at CBRE – In an evolving market environment, sectors such as student housing, hospitality and healthcare offer significant opportunities because they broaden the concept of real estate investment in the narrow sense, responding to structurally sound social demand without sacrificing financial returns.”

UNDER THE BANNER OF TRANSPARENCY TO BETTER MANAGE ESG RISKS AND OPTIMIZE OPPORTUNITIES

In Agenda 2025, an important page is also dedicated in Italy to the sustainability where it is noted how new regulations on ESG risk transparency are now being demanded by investors themselves, not only by the regulatory framework, also revealing opportunities that can optimize the performance of assets and investment throughout Europe. From the Italian Investor Intentions Survey it emerges that the 68 percent of respondents are planning to retrofit buildings existing to meet the required standards, while 60 percent are actively purchasing or implementing green building. What is certain is that precisely the assessment and prevention of ESG risks will play an essential role in ensuring the quality of information and profitability of investments, as well as to facilitate access to financing at subsidized interest rates. The evaluation of the risks associated with climate change is becoming a recurring theme, considered by 95 percent of investors a key consideration in guiding their decisions, a finding that goes in concert with the position stated by 45%, who say they would be willing to pay a premium of more than 10% to buy assets sustainable. According to the study, in addition, investors mostly use their own resources to retrofit existing buildings (70%), but they also ask for support from the tenants (37%), through, for example, clauses of green lease. In this sense, green loan or sustainabillity-linked loan are increasingly in demand, as they are considered to offer more favorable terms than traditional financing.