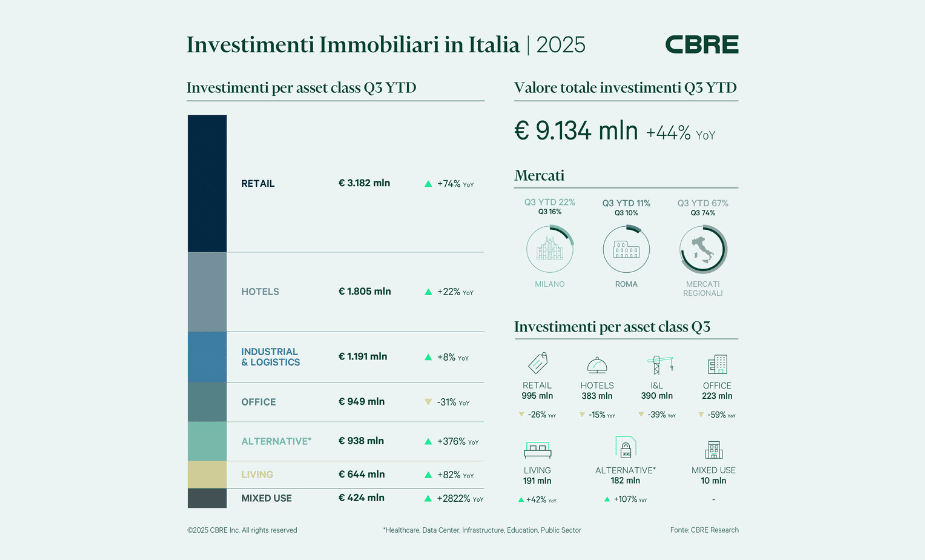

Retail and Regional Markets Drive Growth in Italian Commercial Real Estate: €9.1 Billion in Investments in the First Nine Months of 2025

In the first nine months of 2025, investments in the Italian commercial real estate sector reached €9.1 billion, marking a 44% growth year-on-year. Of this total, €2.37 billion was recorded in the third quarter. Despite the uncertainty in the geopolitical context, solid fundamentals and capital availability continue to support the market.

Investment volumes in commercial real estate remain driven by the Retail market, which confirms its role as the protagonist of this growth phase. In the third quarter, Retail investments neared one billion euros, for a total of almost €3.18 billion invested since the beginning of the year, a 74% increase compared to the same period last year. High-ticket transactions in the out-of-town segment, particularly a large prime shopping centre and a factory outlet portfolio, provided a decisive boost, confirming the return of investors to this sector, who are attracted by the good fundamentals this market is currently able to offer.

Investments in the Office sector continue to suffer from a lack of product, despite renewed interest in prime markets. In the first nine months of 2025, investments in the office sector reached €949 million (down 31% compared to last year), with €223 million invested in the third quarter. A recovery in volumes is expected for the coming months, supported by a solid pipeline and fundamentals that remain strong: rising rents in Central Business Districts, greater availability of debt capital, and reduced financing costs are all factors that reinforce the prospect of yield compression.

The Industrial & Logistics market continues to register good investment volumes, with €1.19 billion invested in the first nine months of the year (an 8% increase compared to the same period in 2024), of which €390 million was in the third quarter. This is a positive result despite the normalisation of occupier demand and uncertainty surrounding commercial policies. Activity is led by core-plus and value-add investors seeking higher returns.

In the first nine months, the Hotels sector recorded investments of €1.8 billion, up 22% compared to last year, with €383 million concentrated in the third quarter. In this sector as well, the value-add component continues to drive the market, although there has been an increase in the weight of core investments in the third quarter. Conversely, the component of investments by owner-operators is down, although their interest in the Italian market remains positive. The development pipeline remains significant, while the stabilisation of hotel performance in the luxury segment could push more speculative investors toward the upscale and mid-scale sectors, where growth margins appear more promising.

In the Living market, the third quarter recorded volumes of €191 million, with approximately half driven by Student Housing transactions, where the contribution of forward purchase operations remains highly significant. Overall, in the first nine months of 2025, Living sector investments reached €644 million, marking an 82% growth compared to the same period of the previous year. The launch of new developments, especially in Milano, is suffering from increased caution linked to the permitting context: several developers are shifting their strategies toward the redevelopment and conversion of existing buildings, preferring these over new construction.

In the third quarter, the Alternative market recorded €182 million in investments, for a total of €938 million since the beginning of the year. The weight of the Healthcare sector in the last quarter was contained, with small-sized transactions involving clinics and assisted social-healthcare facilities. The disposal of instrumental assets by infrastructure operators, however, attracted the attention of private investors, contributing to the majority of Alternative investments this quarter. A further contribution came from the Education segment, which recorded transactions exceeding €220 million in the first nine months of the year.

In the regional markets, investment volumes in the first nine months of the year amounted to over €6 billion, representing 67% of the national total. This is a record result, fuelled by large out-of-town Retail transactions, followed by the Industrial & Logistics sector and the Hotels and Alternative segments.

“The growth recorded in the Italian commercial real estate sector in the first nine months of 2025, with the return of Retail among the most attractive asset classes, reflects the sector’s solidity. Furthermore, the vibrancy of the regional markets, which are increasingly strategic, is compensating for the limited availability of assets in the more consolidated markets of Milano and Roma,” states Silvia Gandellini, Head of Capital Markets Italy at CBRE. “This trend highlights the structural strength of the market and the growing confidence on the part of investors, confirming Italy’s strategic role in the European landscape.”

For further information: Spencer & Lewis for CBRE