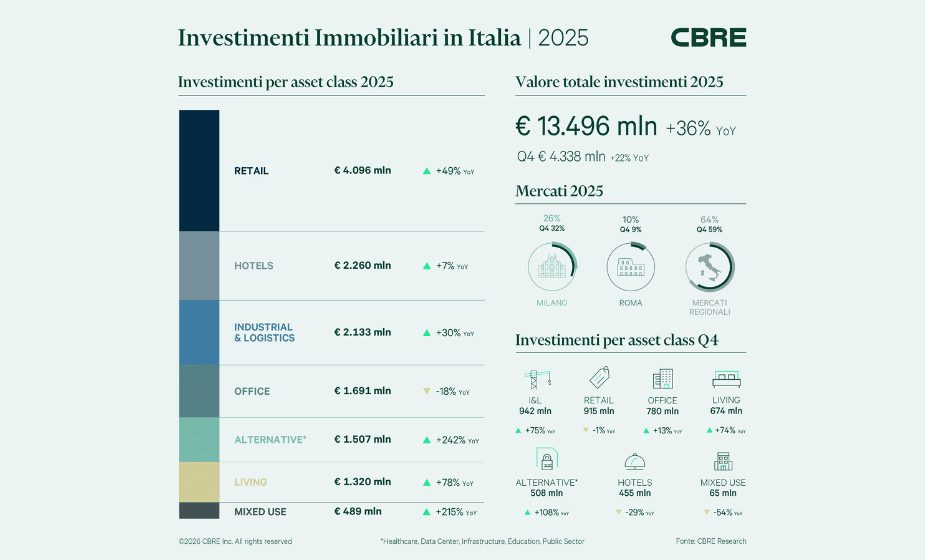

Italian Commercial Real Estate at All-Time High with over 13 Billion Euros in Investments in 2025. Growth Driven by Regional Markets, Retail, and Hotels

2025 closes with a record result for investments in Italian commercial real estate: 13.5 billion euros in investments, up 36% compared to 2024, marking the best year ever and surpassing the previous record of 12.6 billion euros set in 2019. The final quarter of the year contributed significantly, with over 4.3 billion euros and an increase of 22% compared to the same period of the previous year.

Significant support for this performance came from regional markets—transactions outside the Milan and Rome markets—which grew by 81% compared to 2024 for a total of 8.7 billion euros. The return of core investments, representing 40% of the transacted volume, and the contribution of private capital, responsible for 20% of investments in 2025, further sustained the market. A key role was played by the improvement in debt access conditions, thanks to an increase in active lenders, which encouraged competition and balanced the rise in costs.

The Retail sector is the top asset class by investment volume in 2025, with a record volume of approximately 4 billion euros invested since the beginning of the year. The 49% growth in volumes compared to last year was favored by the increased availability of debt capital, particularly in out-of-town segments. Here, there is an increase in both the number of large-ticket deals on prime and good secondary products by core+ players, as well as smaller-scale operations with a more opportunistic approach. Interest in the most prestigious high street destinations remains high, especially from private investors and retailers.

The Hotels sector closes 2025 with its second-best result ever in terms of investment volumes, reaching 2.26 billion euros, up 7% compared to 2024. Value-add investment activity remains predominant even in the fourth quarter, representing 80% of volumes, and is focused on properties to be converted or hotels to be repositioned. Interest in stabilized properties is also growing, opening positive prospects for core investors during 2026.

Investor interest in prime locations with high-end positioning remains solid, while at the same time, there is a progressive growth in appetite for mid-to-high-end income-producing properties in secondary cities. These cities benefit from good growth prospects in tourist flows, thanks to the recovery of European business travel linked to the MICE (Meetings, Incentives, Conferences, and Exhibitions) sector.

The final months of 2025 also closed with positive results for the Industrial & Logistics market, which, after a period of adjustment in the occupier markets, has returned to recording increases in both take-up and investments. 2025 closes with 2.13 billion euros in investments, up 30% compared to 2024. The return of core capital to this sector, thanks to an intensification of fundraising activities, was accompanied by a selective attitude in choosing locations.

Interest in value-add operations is mainly concentrated on brownfields but faces the limited availability of large-scale properties where intervention is cost-effective. Investor selectivity toward locations with a more solid occupier market is limiting greenfield development activity in secondary markets, which remain primarily the domain of specialist investors.

The Office sector closes 2025 with investments at 1.7 billion euros, down 18% compared to 2024, but with a decisive acceleration toward the end of the year, recording a 13% growth compared to the last quarter of the previous year. These volumes exclude the Office component of prime mixed-use properties. However, confidence in the fundamentals of this asset class in prime locations is improving. The growth in the last quarter was supported by the return of institutional capital, responsible for 50% of the quarter’s volumes, as well as by family offices and private investors. Prospects for 2026 indicate a progressive recovery in investment volumes, thanks to a healthy pipeline of products on the market and growing interest from core/core+ investors.

In 2025, the Living sector also reached a record investment volume for the Italian market, with 1.3 billion euros (+78% over 2024), driven by the Student Housing segment. This segment remains dynamic, with value-add operations and forward purchases on development projects with low urban planning risk. Major university cities remain the focus of investments, but interest is also growing in other regional cities. Despite the limited number of investment opportunities, the sector is attracting more and more newcomer investors who recognize the growth potential of the Italian market.

In the residential segment, investment activity is increasing but remains limited by the scarce availability of opportunities in the Multifamily/Built-to-Rent sector. Operations destined for fractional sales currently remain the primary destination for investments, especially for properties to be redeveloped within the established urban fabric, thanks to local developers often supported by private investors.

Good results were also recorded for Alternative asset classes, with 1.5 billion euros in investment volumes, thanks primarily to the Healthcare sector, which saw major platform deals. Data Centers continue to attract investors, aided by the low vacancy rate in the Italian market, stimulating land purchases, although location selection remains very selective.

“Based on the analysis of the data collected and the trends recorded, we can say that Italian commercial real estate is entering a new phase, characterized by increasing diversification of investments, both by asset class and location,” says Silvia Gandellini, Head of Capital Markets Italy at CBRE. “We are witnessing an expansion of the investor base, thanks to international newcomers, private capital, and end users. The record volumes of 2025 demonstrate the resilience of the Italian market, and the prospects for 2026 are very positive, thanks to a solid pipeline of deals and growing fundamentals across all sectors.”

For further information: Spencer & Lewis for CBRE.